Cash is no longer the default choice for Australian consumers. In fact, the shift toward digital payments has been staggering. According to the Reserve Bank of Australia, just 13% of transactions were made with cash in 2022, compared to 37% in 2007—a clear sign that businesses must evolve to meet changing customer preferences.

From the convenience of contactless card payments to the growing popularity of mobile wallets and online platforms, digital payment methods have become a cornerstone of modern commerce. They’re faster, more secure and better suited to the on-the-go lifestyles of today’s customers.

For small business owners, keeping up with these trends isn’t just smart—it’s vital for staying competitive. In this guide, we’ll explore the various types of digital payments, why you should start accepting them and how you can get started to ensure your business is ready to thrive in a cashless economy.

What are digital payments

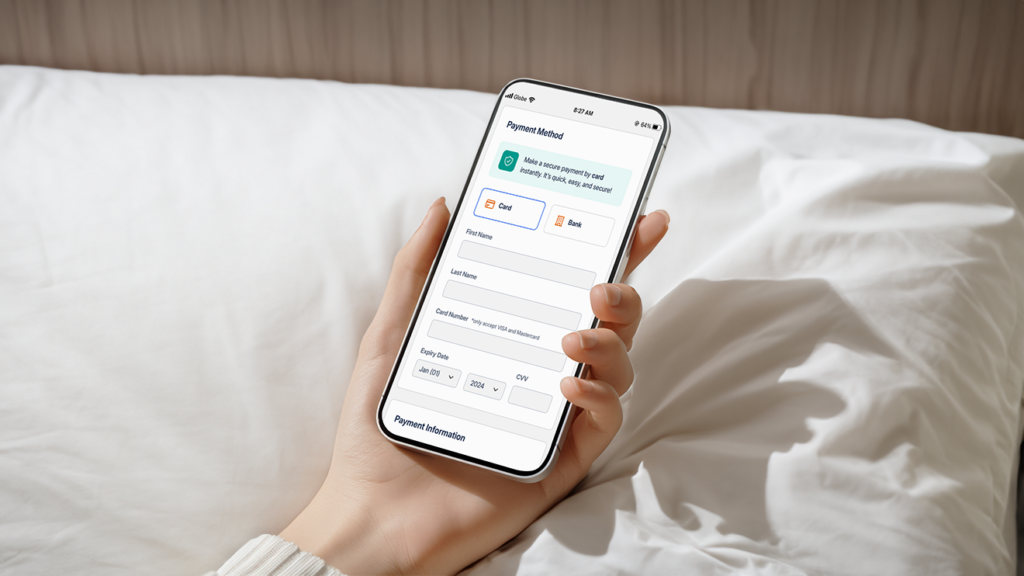

Digital payments are electronic transactions where money is transferred between parties without the use of physical cash. These payments leverage technologies like mobile apps, secure online platforms and contactless terminals.

Digital payments streamline the transaction process, reduce errors associated with cash handling and cater to customers’ growing preference for cashless solutions.

Popular digital payments methods in Australia

Small businesses in Australia can choose from a variety of digital payment methods to meet customer expectations. Here are some of the most widely used:

1. Contactless card payments

Contactless payments use tap-and-go technology to enable quick and secure transactions. Customers can simply tap their cards on a terminal, making checkout faster and more efficient. This method has become a staple for retail businesses, helping reduce queues and streamline in-store operations.

2. Mobile wallets

Mobile wallets store payment information on smartphones or wearable devices, offering a seamless tap-to-pay experience. They provide an added layer of security through tokenisation and biometric authentication, making them a popular choice for businesses aiming to cater to tech-savvy customers.

3. Online payment gateways

Online payment gateways facilitate secure transactions through websites or mobile apps. They are essential for eCommerce businesses, supporting a wide range of payment options, such as credit cards, debit cards and direct bank transfers. Gateways often come with fraud prevention tools, ensuring the safety of both businesses and their customers.

4. QR code payments

QR codes are scanned by customers using their smartphones to initiate payments. This payment method is growing in popularity due to its simplicity and minimal infrastructure requirements, making it ideal for small businesses and pop-up stores.

5. Direct debit

Direct debit enables automatic withdrawal of payments from a customer’s bank account on a recurring schedule. This option is widely used by subscription-based services and ensures timely payments, improving cash flow and reducing manual invoicing efforts.

Why your small business should accept digital payments

These days, digital payments aren’t just a nice-to-have—they’re what customers expect. Offering modern payment options makes life easier for your customers while keeping your business ahead of the curve and running smoothly. Here’s why your small business should accept digital payments:

- Keep up with customer preferences – Australians are all about convenience and speed these days, and cashless payments are at the top of their list.

- Boost your sales – Making it easy to pay means fewer hurdles for customers, which can lead to more purchases – both in-store and online.

- Reach more customers – From online shoppers to international buyers, accepting digital payments opens the door to a much wider audience.

- Make life simpler – Digital payments take the hassle out of record-keeping and cut down on the need to manage cash manually.

- Stay secure – Modern payment systems come with built-in fraud protection and encryption, giving peace of mind to you and your customers.

How to start accepting digital payments for your small business

Step 1: Find the right payment options

Start by figuring out what works best for your business. A contactless card reader is perfect for physical stores, while online payment gateways are ideal if you’re running an eCommerce site.

Step 2: Get the technology you need

Make sure you have the right tools in place. This might mean investing in a reliable POS terminal or setting up software to support payment gateways and mobile wallet integrations.

Step 3: Choose a payment provider

Partner with a provider you can count on, like MuliPay, which offers flexible solutions for managing multiple payment methods safely and efficiently.

Step 4: Train your team

Your staff should feel confident handling digital payments. Take time to show them how to process transactions and resolve common issues smoothly.

Step 5: Spread the word

Let your customers know about your new payment options! Use in-store signage, social media posts, and email updates to make sure everyone’s in the loop.

How to integrate alternative payment methods into your business

Adopting digital payments doesn’t have to be overwhelming. With a platform like MuliPay, Australian small businesses can easily integrate and manage various payment methods. MuliPay offers unified solutions, supporting everything from contactless and online payments to recurring billing.

The platform is also highly customisable, so you can tailor your payment workflows to meet your specific business needs. Whether you’re just starting or looking to scale, MuliPay’s scalable options grow with you, keeping your payment solutions flexible and future-proof.

By choosing a reliable platform like MuliPay, you can stay ahead of the competition, meet customer expectations, and streamline your payment process without the stress.

Digital payments aren’t just the future—they’re already here. As Australians increasingly move away from cash, it’s more important than ever for small businesses to embrace cashless payment methods. By selecting the right solutions, getting your team on board and partnering with a trusted provider like MuliPay, you can boost customer satisfaction, increase sales and keep your business competitive in a fast-changing market.

Ready to make the leap to digital? Contact our payment experts today and discover how MuliPay can simplify your payment process!